In Washington State where I live they just passed a tax on “live presentations”. The way the new tax is described it’s unclear as to whether I’m supposed to start charging sales tax. Previously, service businesses didn’t have to charge sales tax.

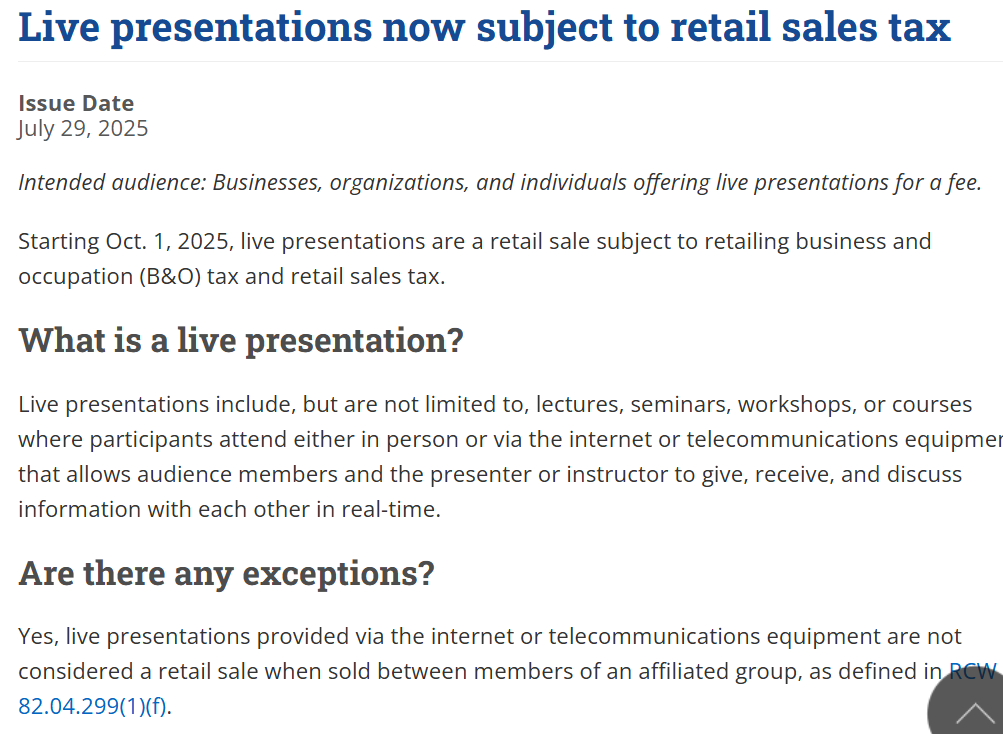

Here’s what the rule looks like on their state’s website:

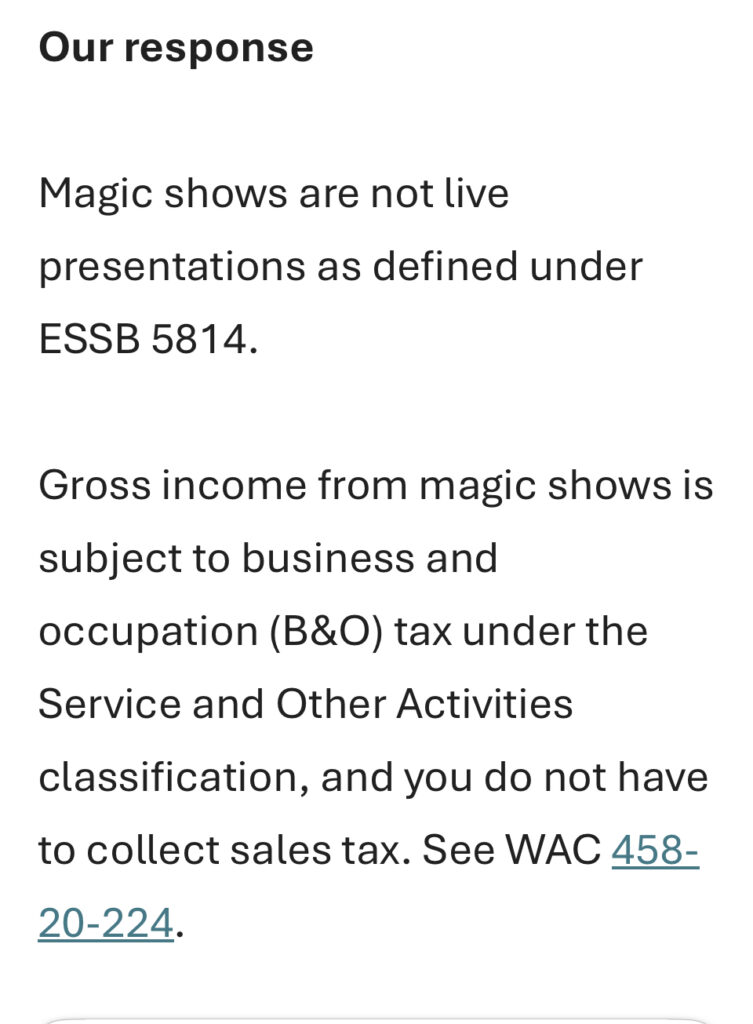

The state has an email address that you can use to get an official ruling as to what you’re supposed to do. I sent them a question asking them if I have to start charging sales tax and here’s what the state had to say:

That’s great news, as the new rule took effect on 10/1/25, and I had shows scheduled with “all inclusive” pricing long before this new tax was announced. Those shows I’d lose 10% on, so I’m glad that magic shows are exempt (for now) from this new tax!

If you’re in Washington State and do magic shows, you should email the Department of Revenue and get an official, binding ruling for your business.

-Louie